Investing in diamonds

Since the beginning of time people with means of investment have been considering how to diversify wealth most optimally to achieve maximum yield and minimum effort. At the same time they were troubled how to secure such means to guard against all political, economic and natural influences. The economic science of today clearly defines the concepts of yield, risk and liquidity, which characterizes each investment.

Unfortunately, no individual investment vehicle can cover these three criteria optimally. Therefore an investment portfolio came into existence- asset allocation and investment. An old proverb says: divide the property in three parts. Let one third be active – for example one´s own business activities. One third produce fixed income - for example, real estate, paper assets. However, keep one-third save as "reserves for the bad times“ which should ideally be passed on to the next generation. From time immemorial this is where gold, precious stones and diamonds in particular hold a strong position.

10 Reasons why investing into a diamond from Diamonds International Corporation is a advantageous alternative.

INVESTICE

10 Reasons why investing into a diamond from Diamonds International Corporation is a advantageous alternative.

1. Maximum concentration of wealth

There is no comparable value for an equivalent amount. The most expensive diamond sold by D.I.C. a.s. is a 11.83 ct /G/F with a price of 1.2 million EUR excluding tax (a brilliant cut of 14.6 mm in circumference and 9mm in height). 60kg of gold is of comparable price. With high mobility, easy and inconspicuous transport, there is no embargo on cut diamonds anywhere in the world.

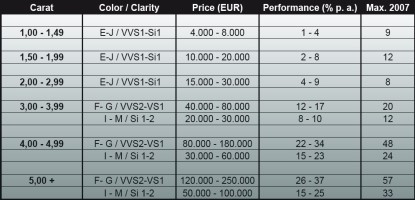

2. Constant growth in price

It has continual international growth in price without fluctuation as with exchange rates and other commodities.

3. Most stable investment for the last decade

Over time and due to its conservative and constant increase the diamond has been assessed together with gold as a stable investment vehicle. This is reflected especially in times of economic crisis. Since mid-2007, interest in the investment in diamonds rapidly grew (related to mortgage crisis), which raised their cost very significantly until mid-2008. Since then the price is stable (but strength of the dollar is growing which is reflected in the increase in real value), only towards the end of 2008 there was a slight decrease in market prices. In spite of it, the total increase for the year 2008 was positive.

4. Diamonds have no boundaries

The value of diamonds gets converted through US dollars and is the same throughout the world. The most effective place for trade is the diamond stock exchange, of which there almost 30 across the world.

5. Symbol of wealth and prosperity

Since ancient times gold and diamonds were part of treasures, royal jewellery and heritage of descendants. Today, for example, we could not imagine the Queen of England in the public without beautiful diamond jewellery. All popular personalities also decorate themselves with some diamond jewellery.

6. Discreet wealth

If you own real estate, a car, a ship or a plane, one can find out when inquiring at a real estate register the type of your wealth. If you collect antiquities, you cannot escape the attention it generates in your surroundings. But of course with diamonds, if you want to, no-one will know except you. One can easily hide it from the envious eyes of society, competition and neighbors.

7. Diamond jewelry – Timeless gift

The aesthetic value of a diamond is already visible on first sight. Diamonds are eternal and inspiring with its beauty and glitter which doesn´t present itself as only a rational investment, but also a passion. As a gift it always expresses the depth in a relationship and cannot be forgotten. It is passed on from generation to generation for centuries. It bonds on a personal level with its owner for the rest of his or her life. It is a possession that isn´t visible and becomes a valuable family jewel with tradition when inherited. And finally as jewelry, to take full advantage of a diamond can offer, it can be set into some of the precious metals. Thus one may create original jewelry whose main value lies in the diamond.

8. Diamond creates tradition

A diamond as an investment and effective safekeeping of property has been used for centuries. It has always combined beauty and high quality. At present 7% of free financial resources from citizens of the EU are invested in diamonds. It expresses the cohesion of ancestry in the course of time when passed down from generation to generation.

9. Exceptional physical properties – Diamond as an indestructible investment

All the above mentioned points are possible only due to the exceptional physical properties of this crystal. It is the hardest substance in our planet which is resistant to all chemical compounds, high temperatures (up to 1300°C) and forces (attention!!! It is however brittle).

10. Strong business partner

The company Diamonds International Corporation - D.I.C. a.s. is a pure Czech shareholder and member of the oldest diamond bourse in Antwerp. It cooperates with the biggest diamond-cutting shops in the world as well as prestigious gemological laboratories. It specializes in the production of original jewelry and consultation in the field of diamond investing. When buying a diamond it automatically issues a certificate from an internationally acknowledged laboratory. It is absolutely the largest seller of loose diamonds in the Czech Republic.